- Main event, market trends highlighted.

- WIF surge, ILV decline today.

- No new institutional updates noted.

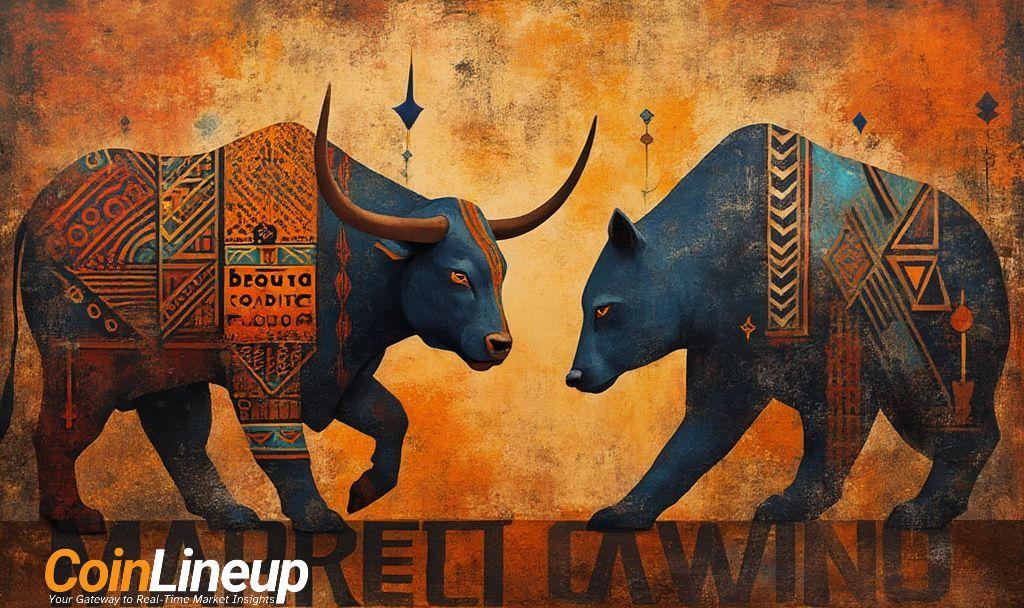

Market Analysis

Rising WIF prices underscore growing speculation in meme coins, with current movements lacking direct company or institutional announcements. ILV’s modest dip aligns with normal volatility patterns.

WIF saw a significant rise attributed to speculative retail trading, fueled by interest in Solana-based meme tokens. The memecoin rose 12.43%, reaching levels near its February high. No major trading volumes were recorded on primary platforms today.

WIF’s price action mirrors previous runs in meme coins like Dogecoin.

Meanwhile, ILV’s 2.19% drop shows typical fluctuations seen in gaming tokens without specific catalyst events.

The market response to WIF’s increase highlighted the speculative nature of meme coins, while the ILV dip remained within expected volatility. No regulatory interference or primary announcements were observed influencing today’s market shifts.

Institutional and Retail Activity

ILV co-founders did not release new updates, focusing on development milestones instead. In contrast, WIF’s rise reflects possible retail-driven speculation, unrelated to major institutional changes. Monitoring short-term movements remains crucial for investors.

Analysts suggest watching trend data and Solana’s ecosystem impacts for potential investment opportunities. Historical meme coin trends highlight risks, emphasizing the volatility inherent in WIF and similar tokens. Solana’s role in speculation becomes a focal point for observers.

It appears that there are no direct quotes from key players, influencers, or industry experts related to the specific news about WIF and ILV market movements. The update indicates that although there are notable price changes for WIF (+12.43%) and a decline for ILV (−2.19%), there are no significant official statements from leadership figures or prominent market voices commenting on these specific price actions.