- Roger Ver agrees to $48 million tax settlement.

- DOJ prosecutes high-profile crypto case.

- Bitcoin is primary asset in settlement.

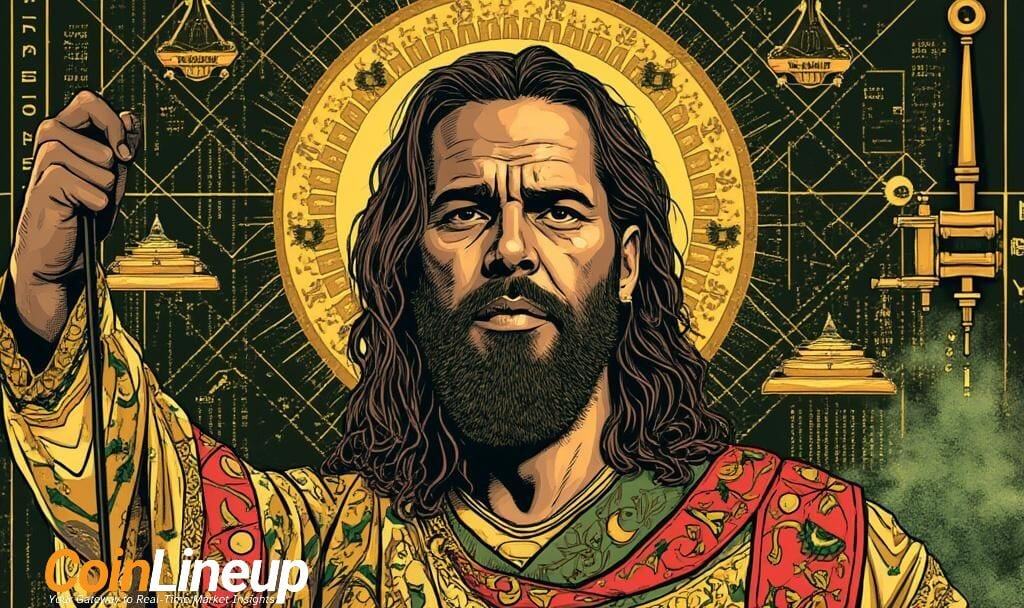

Roger Ver, known as “Bitcoin Jesus,” is set to pay $48 million to settle tax fraud allegations with the DOJ, avoiding jail time. This agreement centers on Ver’s past cryptocurrency holdings, specifically Bitcoin (BTC), dating back to 2014.

Roger Ver, referred to as “Bitcoin Jesus,” has agreed to a deferred prosecution deal with the U.S. Department of Justice. The agreement includes a $48 million payment to settle tax fraud claims related to cryptocurrency.

Ver’s settlement with the DOJ is significant due to its high-profile nature and the substantial amount involved. The broader implications are being watched, as it may influence future regulatory approaches to high-profile crypto figures.

Roger Ver, a prominent figure in the cryptocurrency space, known for his early adoption and promotion of Bitcoin, has avoided jail time by agreeing to this settlement. The settlement, once approved, will resolve past tax obligations tied to Ver’s Bitcoin holdings. The U.S. Department of Justice, responsible for the prosecution, is taking a firm stance on such high-profile cases. There has been no public comment from Ver or the DOJ regarding the deal, but court approval is pending.

Bitcoin is the primary cryptocurrency affected by this case. There is no evident impact on Ethereum or altcoins. The case has not led to discernible changes in on-chain data or liquidity. Historical precedents show that while such cases have occurred before, they have largely involved smaller-scale players. The scale and profile of Ver’s settlement with the DOJ highlight its unique nature.

Immediate effects on the market appear limited to Bitcoin. Tax enforcement signals an increased regulatory focus on cryptocurrency holdings for high-profile individuals. Financial markets, however, show no drastic shifts following the announcement.

Politically, this settlement could shape how authorities pursue similar cases in the future. The settlement emphasizes the need for individuals to comply with tax laws, especially when dealing with substantial cryptocurrency assets. “I cannot comment on the pending legal matters at this time,” said Roger Ver regarding the settlement. Given historical trends, markets appear largely unaffected in the short term, but long-term implications on regulatory approaches remain to be assessed.

The potential financial ramifications could lead to further scrutiny of high-profile crypto investors. This case sets a possible precedent for tighter regulations. While no new regulations have been announced yet, the broader industry remains vigilant for any changes. Industry observers will continue analyzing technological and regulatory outcomes. Strong enforcement drives home the message of tax compliance within cryptocurrency investments.