- Compound DAO rejects $13 million clawback proposal.

- 70% voting power opposed recovery.

- Decision maintains existing allocations in governance initiative.

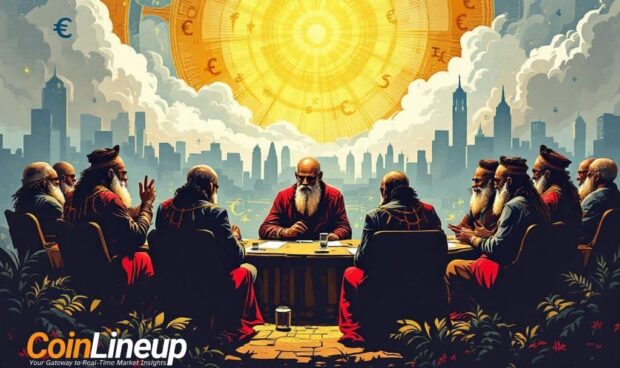

Compound DAO rejected the proposal to recover around $13 million in COMP tokens from Special Representatives. The community voted nearly 70% against it, highlighting ongoing governance debates within the protocol over token distribution and control issues.

The rejection highlights the community’s priority on maintaining governance token allocations, ensuring stability amidst possible ‘DAO capture.’ Market impact on COMP remains minimal, reflecting controlled volatility expectations.

The proposal addressed returning $13 million from a governance incentive allocated in August 2024. The primary purpose was enhancing governance participation through the Delegate Race program, funded by the Compound treasury.

“The token allocation serves as a defense against ‘DAO capture,’ a scenario where a whale or group amasses enough governance power to control votes.” — Anonymous DAO Delegate, Compound DAO

Key figures include Compound DAO and special representatives like PGov who opposed the initiative. The whale Humpy notably supported recalling the tokens, showing varied perspectives on governance strategies.

The decision had limited direct market impact, with COMP’s recent price movements within expected volatility. Compound’s market cap remains robust at approximately $487.6 million, with $2.98 billion in total value locked.

These governance decisions emphasize growing challenges in DeFi systems. Observers find significance in managing interest conflicts similar to those seen in July 2024 when treasury allocations attracted controversy.

Understanding of financial, regulatory, or technological trends may develop as large-scale governance issues are addressed. The effective management of these matters is essential for DAO credibility and participant trust in decentralized finance.