| Sponsored Post Disclaimer: This publication was produced under a paid arrangement with a third-party advertiser. It should not be relied upon as financial or investment counsel. |

Why crypto is down is the question that keeps resurfacing every time the market swings with no clear trigger. One sharp move can wipe out liquidity, trigger a wave of panic selling, and leave traders guessing what went wrong.

Floating prices offer no protection in moments like these, which is why fixed-price models are suddenly back in focus.

Noomez ($NNZ) fits that shift perfectly, running a controlled curve that doesn’t react to the chaos on live charts.

Instead of chasing unstable bottoms, traders lock their entry and move forward stage by stage. In a market ruled by uncertainty, that kind of structure becomes the real advantage.

What’s Really Happening in the Crypto Market Today

The crypto market today is stuck in a cycle of uncertainty driven by macro pressure and rapid shifts in liquidity.

When Bitcoin dominance spikes, altcoins lose support instantly. Derivatives funding swings amplify every move, forcing traders to react to volatility instead of forming plans.

Retail sentiment collapses the moment large players pull liquidity, and that drop in confidence spreads across every sector.

The result is a market where momentum lasts minutes, not days, making it nearly impossible to hold anything with a floating price. In conditions like this, volatility is the enemy.

Why the Crypto Market Is Down: The Hidden Mechanics Behind the Drop

Most traders only see red charts without understanding why the crypto market is down in the first place.

When leverage piles up, even a small dip triggers forced liquidations that cascade across exchanges.

Market makers exploit this pressure by sweeping liquidity pockets, creating sudden wicks that hit stop-losses and drive prices even lower.

Sector rotations add another layer of unpredictability, shifting money from altcoins to majors in seconds.

Floating-price tokens get punished the hardest because they have no protection against these chain reactions. The market doesn’t need a big headline to fall, mechanical pressure is enough.

Pro Tip: Look at downturns through a trader’s lens: when volatility punishes floating prices, fixed-stage curves often become the only entries that won’t slip beneath you.

Why Crypto Dropping Creates a Rare Window for Fixed-Price Presales

When the market pulls back, most traders freeze because every dip risks turning into a deeper slide.

Crypto dropping creates fear, but it also exposes a timing gap: floating-price tokens fall instantly, while fixed-price presales stay untouched.

That separation gives buyers a chance to position before confidence returns. Instead of fighting volatility, traders secure an entry that can’t be pushed lower by liquidation cascades or sudden liquidity shifts.

In downtrends, the advantage belongs to those who step into models where progress depends on demand, not charts. That’s why structured presales like Noomez ($NNZ) consistently attract attention during unstable periods.

The Fixed-Price Presale Advantage: No Sliding Floors, No Downtrend Exposure

Fixed-price presales give traders something the open market cannot: a stable entry untouched by volatility. When tokens on live charts lose value with every liquidation wave, fixed-price models hold their ground.

There’s no slippage, no unexpected dips, and no forced decisions triggered by sudden wicks. Each stage moves forward on a predetermined curve, creating a clear path instead of a guessing game.

Noomez leans into this structure, running a progressive model that advances only when demand grows, not when the market swings.

In an environment defined by red candles and liquidity gaps, that level of control becomes the edge.

Case Study – Noomez Stage 5 Shows What a Controlled Curve Looks Like

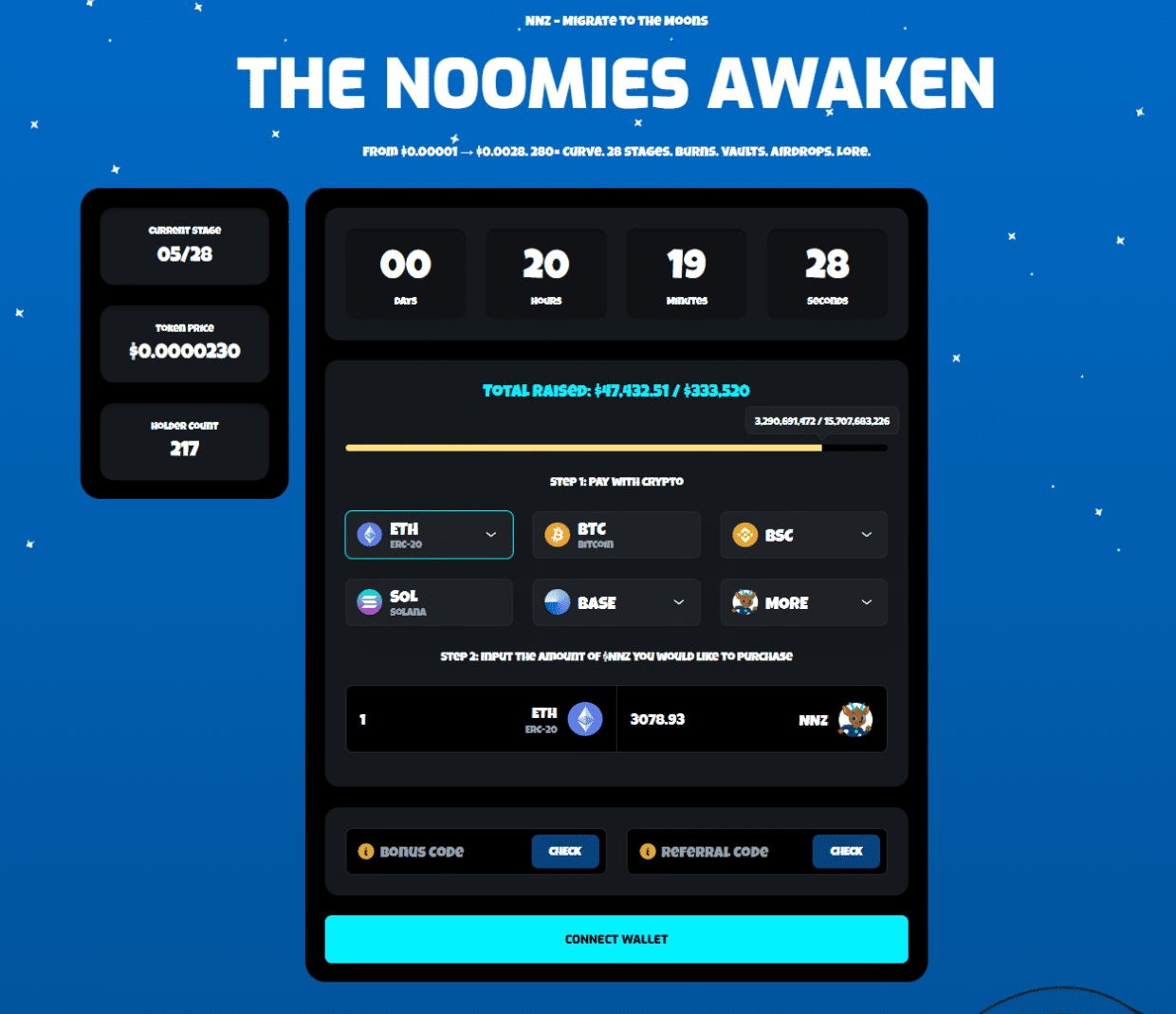

Noomez demonstrates what a structured presale looks like when the wider market is unstable. The project is currently at Stage 5 of 28, holding a fixed $0.0000230 price while the raise climbs past $47,432.51 with 217 holders.

The stage tracker shows 3,209,691,472 out of 15,707,683,236 allocated tokens already secured and many holders locked in, each advancing through a curve designed only to move upward.

The Noom Gauge monitors momentum across each stage, while unsold tokens are burned, tightening supply as demand grows.

Early participants benefit from strong mechanics: 66% APY staking arcs, a 10% referral system, and 6–12 month vesting that protects the chart from instant sell-pressure at launch.

Stage 6 is approaching quickly, and with it comes the next price increase. This is the last chance to load up before the presale moves into a higher bracket, meaning early entries get easier 1000x gains potentially.

Instead of floating in a market that keeps printing new lows, buyers move through a predictable sequence of stages where price rises only when the community pushes the presale forward.

For More Information:

Website: Visit the Official Noomez Website\

Telegram: Join the Noomez Telegram Channel

Twitter: Follow Noomez ON X (Formerly Twitter)

| Disclaimer: The text above is an advertorial article that is not part of CoinLineup editorial content. |